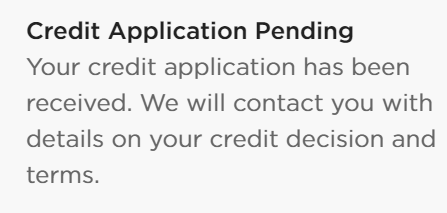

Sometimes, customers may encounter a status of “credit decision pending” in their Tesla account after submitting their credit application.

What does this mean and how long does it take for Tesla to decide on your credit status?

In this article, we will explore the possible reasons for this status and the average time it takes for Tesla to approve or deny your credit application.

How Long Does It Take to Get a Credit Decision?

According to Tesla, many credit decisions are available within a few minutes, with most available within 48 hours. However, some may occasionally take longer due to unforeseen circumstances.

You can check the status of your application in the ‘Payment Method’ section of your Tesla account. You will also receive a notification once your credit decision is ready for review.

Tesla does not disclose the minimum credit score or income requirements for its financing options.

If your credit application is approved, you can accept the financing offer in your Tesla account and a Tesla advisor will contact you with the next steps to take delivery of your vehicle.

If your credit application is denied, Tesla will contact you within one business day of the decision to discuss alternative options.

What Credit Score Do You Need for Tesla Financing?

Tesla does not have a stated minimum credit score to apply for or qualify for a Tesla auto loan. However, your credit score will affect the terms of your loan.

The better your credit score, the lower APR financing you may get. The average credit score of a Tesla buyer in 2020 was 714.

Here is a table showing the range for Credit Score and their category according to Equifax

| S/N | Credit Score | Category |

|---|---|---|

| 1 | 300-579 | Poor |

| 2 | 580-669 | Fair |

| 3 | 670-739 | Good |

| 4 | 740-799 | Very Good |

| 5 | 800-850 | Excellent |

Note that this is just one categorization chart. Several others categorize the credit score a little bit differently.

Can I get Approval with a Bad Credit Score?

Getting a Tesla car is a dream for many people, but it can also be a challenge if you have a bad credit score.

A bad credit score can make it harder to get approved for a car loan or lease, or to get a favorable interest rate.

However, there may be some ways to improve your chances of financing a Tesla with bad credit. Here are some tips and information to help you out.

How to Boost Your Chances of Getting Approved by Tesla Financing?

If Tesla financing has turned you down for any of the above reasons, don’t lose hope.

#1. Pay Down Your Existing Debt

An Important factor that Tesla financing will look at is your debt-to-income ratio, which is the percentage of your monthly income that goes toward paying your debt obligations.

A lower ratio means that you have more disposable income and less financial stress, which makes you more likely to repay your loan.

A higher ratio means that you are overburdened by debt and may have trouble making your monthly payments.

To lower your debt-to-income ratio, you should try to pay off or reduce your existing debt, especially high-interest debt like credit cards.

You can also consolidate your debt into a lower-interest loan or balance transfer card, which can help you save money on interest and simplify your payments.

#2. Improve your credit score

Your credit score is one of the most important factors that affect your Tesla financing approval.

To improve your credit score, and better calculate your car loan terms, you need to pay your bills on time, keep your credit card balances low, avoid applying for too many new credit accounts, dispute any errors on your credit report, etc.

You can also use free tools and services online to monitor and improve your credit score over time.

#3. Increase your income

Your income is another important factor that affects your Tesla financing approval.

To increase your income, you need to find ways to make more money from your current job or find additional sources of income, such as side hustles, investments, etc.

You can also use free tools and services online to track and manage your income and expenses over time.

#4. Choose a different car model

You may want to consider choosing a different car model that is more affordable and available for Tesla financing.

You can compare the features, prices, and availability of different Tesla models on their website or app.

You can also check the inventory of new and used Tesla vehicles in your area or order a custom-made Tesla online.

#5. Check your visa status

You may want to check your visa status and make sure it is valid and up-to-date before applying for Tesla financing.

You can contact the U.S. Citizenship and Immigration Services (USCIS) or your employer to verify your visa status and employment authorization.

You can also consult an immigration lawyer or a financial advisor if you have any questions or concerns about your visa status and Tesla financing.

5 Reasons Why Tesla Can Decline Your Financing Application?

Tesla financing is not for everyone or every car model. You need to meet certain criteria and requirements to qualify for Tesla financing. Some of the reasons why you may get turned down are:

#1. You have a bad credit score

Your credit score is a key factor that influences your Tesla financing approval. Tesla financing usually looks for a good to excellent credit score, which is normally above 700.

If your credit score is below that, you may face a higher risk of rejection or a higher interest rate.

#2. Your income is low

Your income is another key factor that influences your Tesla financing approval. Tesla financing usually looks for a stable and sufficient income that can support your monthly payments and other expenses.

If your income is too low, irregular, or hard to verify, you may face a higher risk of rejection or a lower loan amount.

#3. You have a poor debt-to-income ratio

Your debt-to-income ratio is the percentage of your monthly income that you use to pay your debts, such as mortgages, credit cards, student loans, etc.

Tesla financing usually prefers a low debt-to-income ratio, which is normally below 36%.

If your debt-to-income ratio is too high, it means that you have too much debt compared to your income, which can affect your ability to pay back your Tesla loan or lease.

#4. You chose the wrong car model

Your car model is another key factor that influences your Tesla financing approval.

Tesla financing is not available for all car models and in all states. Some car models may have more demand or less supply than others, which can affect their availability and price.

For example, the Model 3 Standard Range Plus may be more accessible and affordable than the Model S Plaid Plus.

If you pick a car model that is too costly or unavailable, you may face a higher risk of rejection or a longer delivery time.

#5. Your visa status is not valid

Your visa status is another key factor that influences your Tesla financing approval. Tesla financing usually requires a valid U.S. driver’s license and proof of residency.

If you are not a U.S. citizen or permanent resident, you may need to provide extra documents, such as your visa status, employment authorization, etc.

If you have an expired or invalid visa status, you may face a higher risk of rejection or a shorter loan term.

What to Do After Getting a Credit Decision?

Once you get a credit decision, you need to review and sign your loan or lease agreement in your Tesla account at least 24 hours before your delivery appointment. You also need to provide proof of insurance and pay any amount due at delivery.

If you are financing with Tesla, you must e-sign any required documents in your Tesla account. If you are financing with a third-party lender, you need to confirm their information and provide payment or proof of payment for the amount due.

All credit applicants must be present at delivery and bring a valid driver’s license. You also need to bring any trade-in documents if applicable.

Conclusion

Tesla credit is a convenient way to finance your Tesla purchase with a loan or a lease.

However, it may take some time to get a credit decision depending on various factors. You can check the status of your application online and prepare for delivery once you get approved.

Tesla credit is not available in all states and additional taxes and fees may apply.

You should also compare different financing options and shop around for the best rates and terms before applying for Tesla credit.